Can my insurance cover in-home assistance?

Share

Navigating the world of in-home care can be overwhelming, especially when it comes to understanding how insurance can help. Many families face questions like, “What services are covered?” and “Which types of insurance apply?” This blog post aims to clarify how insurance can offset the cost of in-home assistance for your loved ones.

Types of Insurance That May Cover In-Home Assistance

1. Medicaid

Medicaid is one of the most reliable options for covering in-home care, especially for individuals with limited income. Coverage varies by state but often includes:

• Personal care services (bathing, grooming, dressing)

• Homemaker services (meal preparation, housekeeping)

• Companionship and non-medical support

• Skilled nursing and health monitoring

Some states also have waiver programs that expand coverage to include additional services.

2. Medicare

Medicare offers limited coverage for in-home assistance, primarily when medically necessary. To qualify, a doctor must prescribe home health care services, and coverage may include:

• Skilled nursing care

• Physical, occupational, or speech therapy

• Medical social services

• Part-time home health aide services (limited to medical needs)

Medicare does not typically cover non-medical care, such as housekeeping or companionship.

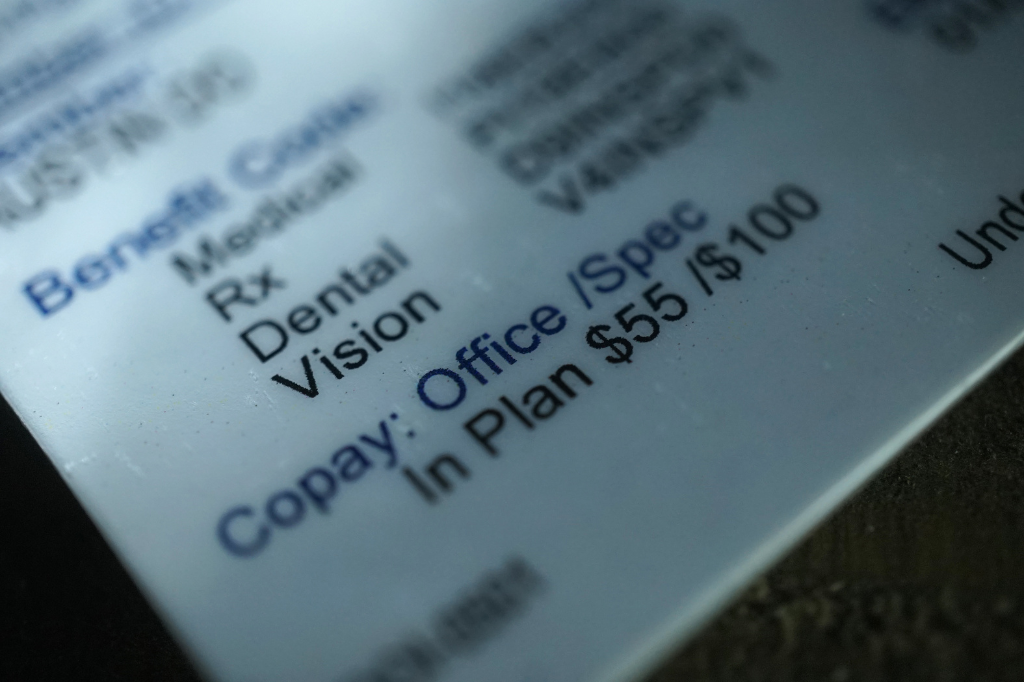

3. Private Insurance

Many private insurance plans offer in-home care benefits, though coverage often depends on the policy. Services covered may include:

• Short-term post-surgical care

• Assistance with chronic conditions

• Skilled nursing or therapy services

It’s essential to review your policy or contact your insurance provider to understand the specifics.

4. Long-Term Care Insurance

Long-term care insurance is specifically designed to cover services not typically included in health insurance, Medicaid, or Medicare. This includes:

• Personal care and assistance with daily activities

• Homemaker services

• Memory care for conditions like Alzheimer’s or dementia

Policies vary widely, so reviewing the terms and conditions is critical.

Steps to Determine Coverage

1. Assess Your Loved One’s Needs

Identify the type of care required—whether it’s medical, non-medical, or a combination of both.

2. Review Insurance Policies

Look at your loved one’s existing insurance plans, including Medicare, Medicaid, private insurance, and long-term care insurance.

3. Consult with Providers

Reach out to the insurance provider or a licensed agent to clarify what is covered under the policy.

4. Speak with a Home Health Aid Company

Many in-home care providers, like Eternal Life Services, can assist in verifying insurance coverage and guide you through the approval process.

What If Insurance Doesn’t Cover Everything?

If your insurance only covers part of the cost, there are other options:

• Out-of-Pocket Payment: Many families choose to pay directly for additional services.

• Veterans’ Benefits: If your loved one is a veteran, they may qualify for assistance through the VA.

• State and Community Programs: Explore local resources that may provide supplemental support.

We’re Here to Help

At Eternal Life Services, we understand that figuring out insurance coverage can be complicated. That’s why we work closely with families to identify options and maximize benefits.

If you’re unsure about what your insurance covers or need help navigating the process, contact us today. Let us help you find the right care for your loved one without unnecessary financial stress.